The qualified business income (QBI) deduction — also called the “Section 199a deduction” — is one of the many write-offs available to lower your tax bill and save money as a business owner. Section 199A(g) provides a deduction for Specified Cooperatives and their patrons similar to the deduction under former section 199, which was known as the domestic production activities deduction. Section 199A(g) allows a deduction for income attributable to domestic production activities of Specified Cooperatives.

Step 1 – Determine the qualified business income for each entity

- In some cases, patrons of agricultural or horticultural cooperatives are required to reduce their deduction under section 199A(b)(7) (patron reduction).

- The qualified REIT/PTP component of the QBI deduction is not limited by a business owner’s W-2 wages and is equal to up to 20% of the qualified REIT and PTP income.

- Then add their sum to anything you need to carryforward from the prior year, and multiply the total by 0.2 to give you the number you’ll list as 20%.

- Any losses from a trade or business that are suspended and not available for use in computing taxable income in the year incurred are not included in QBI for that year.

- The deduction depends on the taxpayer’s total taxable income, which includes wages, interest, capital gains, etc. in addition to QBI.

- In applying the formula discussed earlier, each item in the formula — QBI, W-2 wages, UBIA — is phased out.

- This was a welcome relief for many taxpayers, as it was uncertain how expansive this definition would be.

The calculations also get quite complicated, but TurboTax easily handles them and will figure out how much of a deduction you’re entitled to. We ask for the information on this form to carry out the Internal Revenue laws of the United States. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

- Barbara Weltman is a small business tax expert who contributes to The Ascent and The Motley Fool.

- The Form 8995 used to compute the S portion’s QBI deduction must be attached as a PDF to the ESBT tax worksheet filed with Form 1041.

- If you are a partner, a member in a multimember LLC, or an S corporation shareholder, your share of W-2 wages is reported to you on the Schedule K-1 provided to you by your business.

- Whether rental real estate rises to the level of a trade or business under section 162 depends on all facts and circumstances.

- However, if your taxable income is higher, you are subject to an additional limit.

- All prior year suspended losses allowed allocated to pre-2018 years are Non-QBI.

A Beginner’s Guide to the Qualified Business Income Deduction (QBI Deduction)

- The proposed regulations included a de minimis rule for this situation.

- In order to claim the QBI deduction and take this tax break, small businesses are subject to two requirements.

- Finally, if your business is categorized as a specified trade or business, as discussed more fully below, you may be ineligible for the deduction when total income exceeds certain levels.

- Finally, income earned by a C corporation or by providing services as an employee is not eligible for the deduction regardless of the taxpayer’s taxable income.

- Additionally, the W-2 wages paid to the officer of an S corporation properly allocable to QBI, which are timely filed and reported to the SSA, will qualify as W-2 wages attributable to a trade or business identified by the S corporation for purposes of applying the W-2 wage limitation.

- QBI is the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business, including income from partnerships, S corporations, sole proprietorships, and certain trusts.

Threshold and phase-in range amounts are adjusted annually for inflation. For many TurboTax customers, the calculation is very simple, while for others…not so much. We’ve laid out the details here, but don’t worry if you find yourself getting lost—TurboTax easily handles the new QBI deduction and will let you know if you qualify and how much of a deduction you’re getting. All losses should be entered as a negative number on the worksheet. Your aggregations must be reported consistently for all subsequent years, unless there is a significant change in facts and circumstances that disqualify the aggregation.

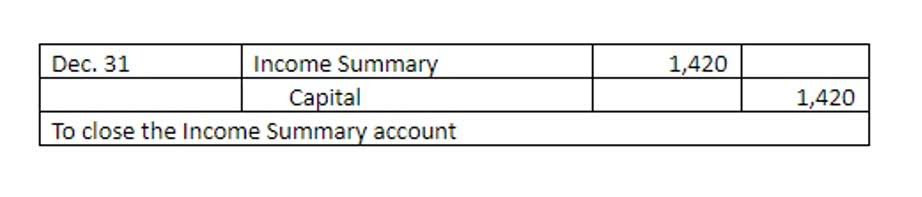

Qualified Business Income Deduction Simplified Computation

In other words, the business passes through its income and deductions to the owners. While various types of business income are eligible for the QBI deduction, certain types aren’t. Wage income, income that’s not included in taxable income, capital gains and losses, https://www.bookstime.com/ and certain other types of income are excluded. The QBI deduction also excludes income generated by foreign currency gains, commodities transactions, and certain dividends. Qualified business income (QBI) is the net income or loss from a trade or business.

Q59. How does the safe harbor provided for in Revenue Procedure 2019-38 apply to mixed-use properties?

The determination of whether clients are considered to be involved with consulting services is a facts-and-circumstances, case-by-case scenario. When making this determination, a CPA should look for instances where the client is providing recommendations and advice without any type of corresponding goods or services, especially if the client is providing a formal written qbid tax recommendation report. Before continuing this discussion, two points need to be made clear. First, if taxpayers are below the threshold amounts, they are eligible for the 20% deduction regardless of whether their business is an SSTB. Second, the SSTB classification applies to the business regardless of whether the taxpayer is actively or passively involved in it.

At higher income levels, the deduction for SSTBs is reduced and in some cases, eliminated. That said, not every eligible business automatically qualifies for the deduction. In particular, some types of service businesses (SSTBs) are disqualified once the taxable income on the return exceeds $232,100 ($464,200 if filing jointly). A worksheet, QBI Loss Tracking Worksheet, is provided below that can help you track your suspended losses.

Step #1: Determine your taxable income

The Difference Between a Tax Credit and a Tax Deduction

- Income earned by a C corporation or by providing services as an employee is not eligible for the deduction.

- ProSeries will automatically generate the simplified or complex QBI Worksheet based on what’s required for your client’s return.

- Keep in mind that it can be hard to figure out, generally, which deductions are available to you and which are not.

- Depending on the taxpayer’s income, the amount of PTP income that qualifies may be limited depending on the type of business engaged in by the PTP.

- As provided in section 162, an activity qualifies as a trade or business if your primary purpose for engaging in the activity is for income or profit and you’re involved in the activity with continuity and regularity.

- But more specifically, it is the net amount of income, gain, deduction, and loss from your business.