As you learn about accounting, you’ll discover different ways to calculate accumulated depreciation. The standard methods are the straight-line method, the declining method, and the double-declining method. Calculating accumulated depreciation is a simple matter of running the depreciation calculation for a fixed asset from its acquisition date to the current date. On the balance sheet, the carrying value of the net PP&E equals the gross PP&E value minus accumulated depreciation – the sum of all depreciation expenses since the purchase date – which is $50 million. After the 5-year period, if the company were to sell the asset, the account would need to be zeroed out because the asset is not relevant to the company anymore. Therefore, there would be a credit to the asset account, a debit to the accumulated depreciation account, and a gain or loss depending on the fair value of the asset and the amount received.

You can account for this by weighting depreciation towards the initial years of use. Declining and double declining methods for calculating accumulated depreciation perform this function. The double declining method accounts for depreciation twice as quickly as the declining method. Here are some scenarios where accelerated depreciation accounting methods might be the right choice. Accumulated depreciation is a contra asset that reduces the book value of an asset.

Understanding Accumulated Depreciation: Definition, Calculation, and Examples

Depreciation expense is then calculated per year based on the number of units produced that year. This method also calculates depreciation expenses using the depreciable base (purchase price minus salvage value). Depreciation expense in this formula is the expense that the company have made in the period.

We handle the hard part of finding the right tax professional by matching you with a Pro who has the right experience to meet your unique needs and will handle filing taxes for you. If you are interested in learning more about depreciation, be sure to visit our depreciation calculator. Additionally, if you are interested in learning what revenue is and how to calculate it, visit our revenue calculator. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee!

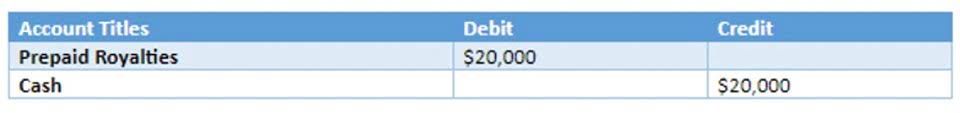

Accumulated Depreciation Journal Entry (Debit or Credit)

In accordance with accounting rules, companies must depreciate these assets over their useful lives. Under the sum of years digits method, a company strives to record more depreciation earlier in the life of an asset and less in the later years. This is done by adding up the digits of the useful years and then depreciating based on that number of years. The IRS publishes depreciation schedules indicating the number of years over which assets can be depreciated for tax purposes, depending on the type of asset. In today’s dynamic commercial real estate market, property owners and managers face the ongoing challenge of optimizing financial performance.

Accumulated depreciation is an essential accounting concept that represents a fixed asset’s total depreciation over its useful life. It is crucial to grasp the definition, calculation, and examples of accumulated depreciation to understand its role in financial statements and its impact on an entity’s balance sheet and income statement. Small businesses have fixed accumulated depreciation: assets that can be depreciated such as equipment, tools, and vehicles. For each of these assets, accumulated depreciation is the total depreciation for that asset up to and including the current accounting period. As mentioned, the accumulated depreciation is not an expense nor a liability, but it is a contra account to the fixed assets on the balance sheet.

Accumulated depreciation vs. depreciation expense

Accumulated depreciation refers to the cumulative amount of depreciation expense charged to a fixed asset from the moment it comes into use. It is used to offset the original cost of an asset, providing a more accurate representation of its current value on a balance sheet. By separately stating accumulated depreciation on the balance sheet, readers of the financial statement know what the asset originally cost and how much has been written off. To calculate accumulated depreciation using the straight-line method, you’ll first need to calculate the depreciation for every year of the asset’s usable lifetime. You do this by subtracting the salvage value, or residual value, from the original purchase price and then sharing the amount by the estimated time the asset will be in service. To calculate accumulated depreciation, you’ll need to add all the depreciation amounts for each year to date.

Accumulated depreciation refers to the total amount of depreciation charged to the cost of a fixed asset since the asset was acquired. It is a contra-asset account, which is reported as a deduction from the asset’s original cost on the balance sheet. You should note that the expense recorded each time is added to the accumulated depreciation account.