If you travel frequently but don’t attribute your travel costs as a business expense for a specific client, the IRS may not allow you to deduct them. Track billable expenses while you travel and be sure to include them on the client invoice. The same situation applies if you incur fees when purchasing materials or supplies to properly service a client. An example of this would be buying additional hardware or software from an online vendor. The vendor may use a payment processor, like PayPal, that charges 2–3% for transactions. That portion of the payment should be listed as billable expense income on any income statement.

QuickBooks Certification: How to Become a QuickBooks Certified Specialist?

You can also account for the time you spend conducting research and performing market research on your client’s goals. One of the most common mistakes regarding billable expenses is lumping billable expenses with your general expenses. Your job and what you are paid for is your intellectual property or the resulting video. However, if you only charge a flat rate for the video alone, you may lose out on a lot of revenue and have a massive variation in your profitability from project to project.

Understanding How To Delete Deposits In QuickBooks

- If you often travel but don’t identify your travel expenses as business expenses for a specific customer, the IRS may not allow you to write them off.

- If you have a client who calls frequently and unnecessarily, for example, billing them for the time is a good way to make those calls worth your while.

- Understanding how to manage billable expenses and income in QuickBooks is crucial for construction business owners and bookkeepers alike.

- With invoicely, though, you can track your regular business expenses and billable expenses all in one place.

- In this scenario, the line item could be considered a billable expense because the client will reimburse you directly for the cost of those ingredients.

Those items could be considered billable expenses and would show up on your final bill as such. The portion of your invoice that covers the trays and burners could be classified as billable expense income, separate from the amount owed for the caterer’s services. If you incur any payment processing fees when receiving payment from a client, you could include that as a billable expense and build the fees into your pricing. The convenience of using digital payment platforms for service providers and clients alike means they are more ubiquitous than ever.

Enable Billable Expenses

Distinguishing between billable and non-billable expenses boils down to understanding whether an extra cost happens because of your work on a specific client or project. You have an invoice stating that you have spent $400 on advertising costs for a new campaign around your client’s product. The payment of $400 that you will receive from your client can be seen both as revenue towards you and as a payment to the initial invoice. The process doesn’t start unless the client accepts your business’ services.

The client, in turn, is expected to reimburse the consulting firm for these billable expenses in addition to the fees for the consulting services. As you can see, the idea of billable expense income is pretty common, especially in the freelancing world. Asking your client to order the supplies or services you need can spell doom to the entire project. At the same time, paying for the tools you need out of your own pockets can eat away your earnings. So be sure to get compensated and have them send the reimbursement to your income account.

Record the flight, rental vehicle, and hotel charges as itemized expenses and put them on accounts payable vs notes payable the client invoice. For example, if you’re a freelance copywriter paid to create blogs, you’ll need to plan out your content. To produce the finest blogs possible, you may need to speak with stakeholders at your company, analyze the competition, and undertake additional digital marketing research.

Common Pitfalls to Avoid

Since 2011, Jayanti’s expertise has helped thousands of businesses, from small startups to large enterprises, streamline invoicing, estimation, and accounting operations. His vision is to deliver top-tier financial solutions globally, ensuring efficient financial management for all business owners. Other expenses such as vehicle use, advertising, and promotional charges are also tax deductible.

Company travel, database connection costs, and business supplies are some examples. Non-billable expenses are charges incurred as a result of your work with a Professional that the client refuses to compensate. Overall, you should pay particular attention to your billable expense income. If left unchecked, it is very likely that you will lose some of your earnings due to paying for your clients’ expenses. So, to avoid financial troubles, keep track of your billable expenses with the aid of invoicing software and bill them to your clients.

Some projects may need equipment rentals, while others may require air travel, and some others may need a long consultation. Failing to track these expenses and letting them jumble in with the general costs can be a huge financial mistake and result in an unnecessarily higher tax bill. Billable expenses are those taken on your client’s behalf that will eventually be charged or passed on to the client or customer. Sometimes referred to as passthrough costs or reimbursable expenses, these expenses are typically ones that your business incurs while providing the goods or services to the client. Everything from travel expenses, project materials, or subcontractor fees can fall under the billable expense category. When you record these expenses in QuickBooks, you can easily mark them as billable to a particular client or project.

We’ve got all the features that you need to automate every aspect of your billing process so that you won’t have to worry about them again. In the same manner, anything you purchase for a customer that they retain ownership of when the work is complete also qualifies as a billable expense. If you’ve been freelancing for quite some time, you’re probably aware that your clients can come from anywhere in the world. With the presence of the internet, it has become easy to communicate across the globe, regardless of time zones and languages. In some cases, working for a long-distance client requires traveling for on-site work or conference team meetings. Once in a while, things fall into place naturally, and a client’s project is done smoothly.

For example, take a look at past instances of how a small catering company would pay for event supplies or a freelance web designer would pay for software licensing. Or a freelancer may have to pay for a domain registration if an existing website is not present. Also include the shipping costs and expenses incurred on the client’s invoice. The customer should be reimbursed for any travel expenses spent as part of a project or on-site work. As a result, save any receipts for travel expenses you pay for a customer, such as those for flights, lodging, and related charges. You can speed up the refund procedure by charging it as a billing item on your expense account and attaching the required documentation.

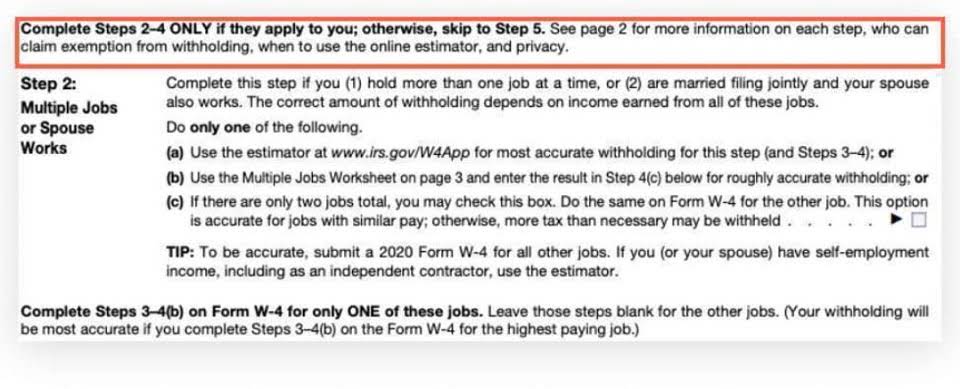

Anything that’s necessary for your business’ day-to-day operation is not a billable expense. For instance, you can’t pass on the cost of printer ink to a client just because you ran out while working on their project. Go to your settings, find the ‘Expenses’ section, and check the box that allows you to track billable expenses and items. Following certain best practices might help businesses in managing billable more efficiently.

While this time is directly related to your services – website copywriting – it is different and might be considered a billable expense. Decimal’s accounting services make it easy to manage your basic accounting bills with just a few clicks and track all expenses with great detail. Instead of spending time processing the financials, our team can handle it for you.

But despite all of the things you need to keep track of, do you need to keep track of your billable expense income? If you’re not, then you could be losing money right now without even knowing it. Invoices from service providers that are needed to complete a job can be passed on to the client.